Use Your HSA/FSA to Buy Ra Optics

We just made it easier, smarter, and cheaper

to protect your health with Ra Optics.

Buy with HSA/FSA

If you’re based in the U.S., you can now use your HSA or FSA account to buy Ra Optics blue light glasses.

Including both prescription and non-prescription lenses.

Prescription and Reader lenses are automatically eligible for HSA/FSA, while Non-prescription glasses are eligible with a Letter of Medical Necessity, which we can help you get via Telehealth.

Why It Matters

Using your HSA/FSA means you’re paying with pre-tax dollars, saving you up to 30–40%, depending on your tax bracket.

How It Works

1

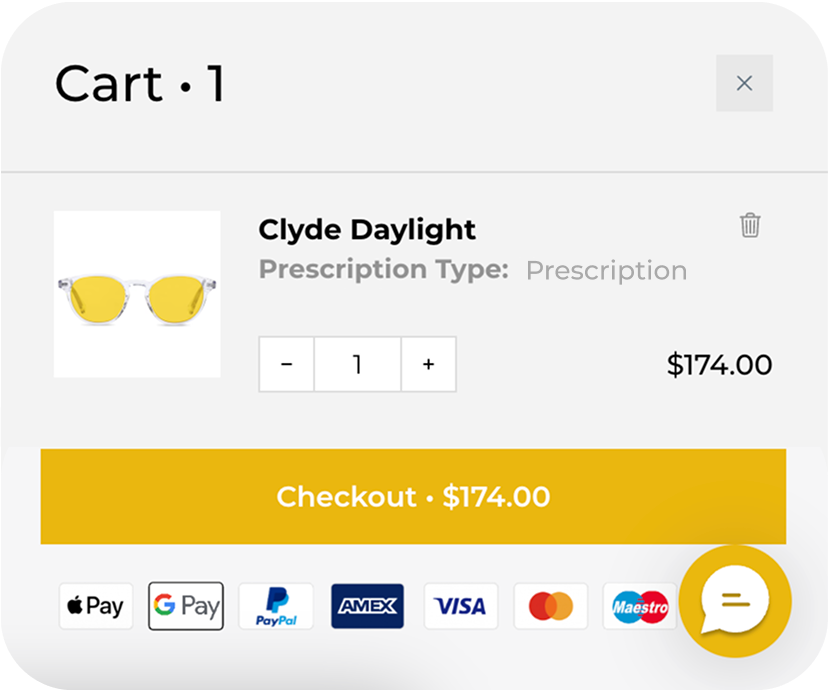

Add products to your cart

2

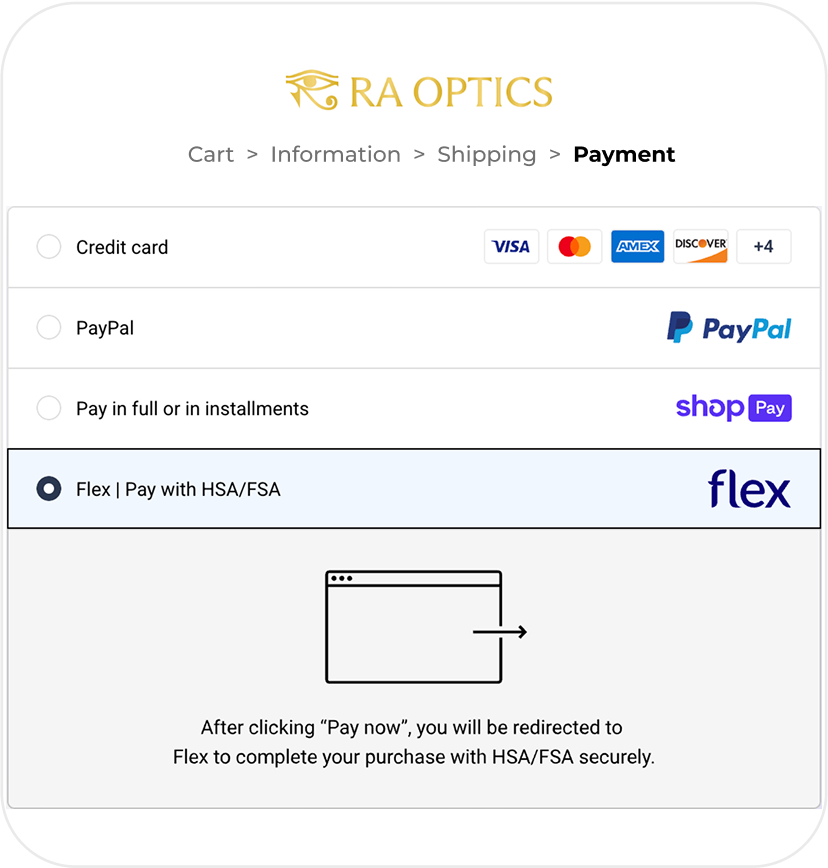

At checkout select

“Flex | Pay with HSA/FSA”

3

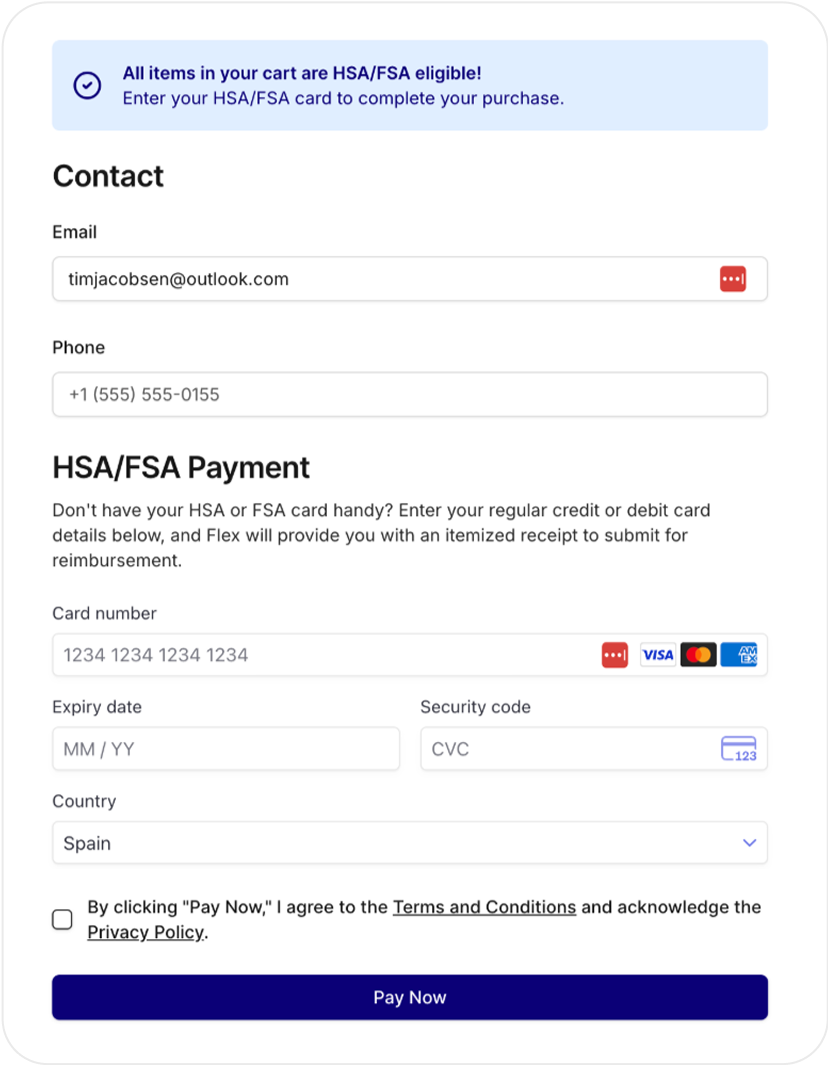

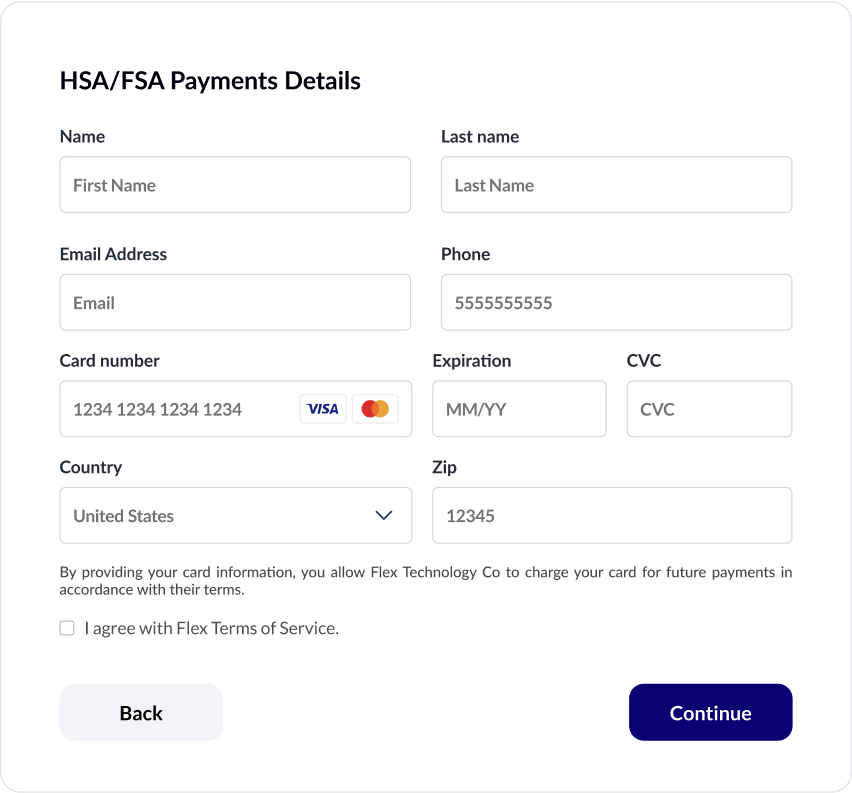

Enter your HSA/FSA

card details

If you don’t have your HSA/FSA card handy, you can still use your credit card and Flex will send you an itemized receipt for reimbursement.

Easy. Fast. And saves you money.

This is just another way we are helping you optimize your life with the Science of Light.

Buy with HSA/FSA

Access Full Benefits with or without a Prescription

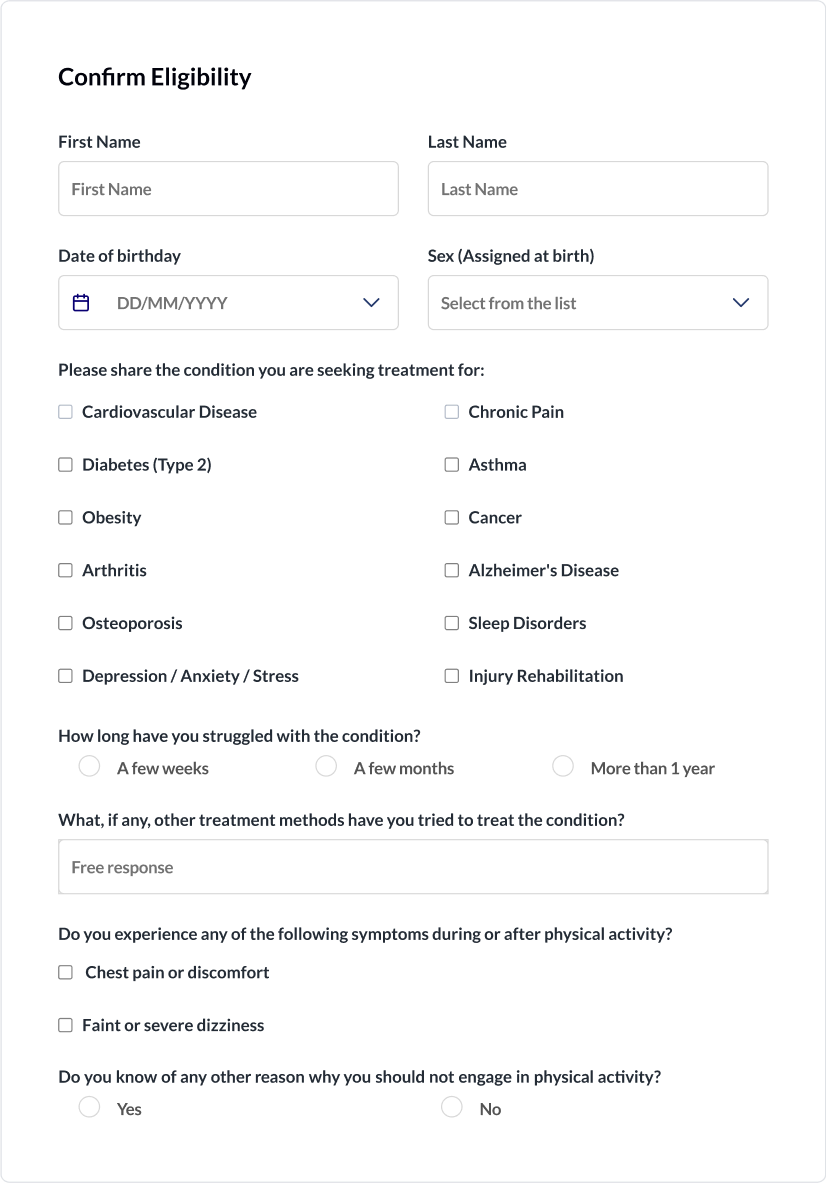

Even if you’re purchasing non-prescription Ra Optics glasses, you may still be eligible to use your HSA/FSA funds.

If your order isn’t automatically eligible, Flex may be able to help you obtain a Letter of Medical Necessity (LMN) through a quick telehealth consult — all online, no doctor’s office visit required.

1

Complete a 2-minute eligibility form online

2

Add your payment details to secure your LMN

3

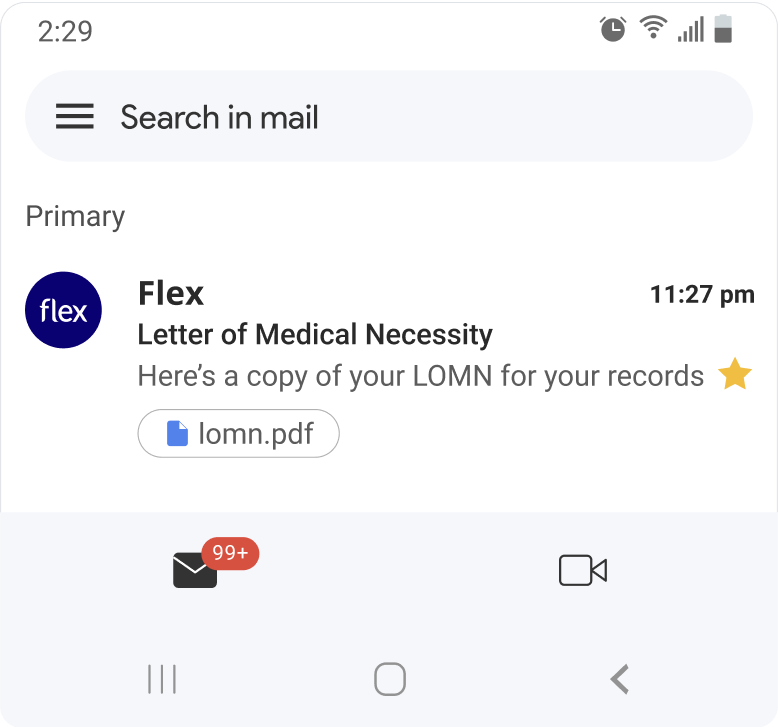

Receive your LMN by email

Once your LMN is approved, you can use your HSA/FSA card at checkout or submit for easy reimbursement with Flex.

Buy with HSA/FSA

Frequently Asked Questions

What is Flex, and what is their relationship with Ra Optics?

Ra Optics has partnered with Flex to allow you to use your Health Savings Account (HSA) or Flexible Spending Account (FSA). This means you can now use your HSA or FSA debit card to buy Ra Optics with pre-tax dollars, resulting in net savings of 30-40%, depending on your tax bracket.

How do I pay with my HSA or FSA card?

To use your HSA or FSA debit card, add products to your cart as usual. At checkout, select “Flex | Pay with HSA/FSA” as your payment option, enter your HSA or FSA debit card, and complete your checkout as usual. If you don’t see “Flex | Pay with HSA/FSA,” you may be in Shop Pay. Select “checkout as guest” to view more payment options.

What if I don’t have my HSA/FSA card available?

If you don’t have your HSA or FSA card handy, still select “Flex | Pay with HSA/FSA” as your payment method. Enter your credit card information, and Flex will email you an itemized receipt to submit for reimbursement.

Why can’t I see Flex as a payment method?

The key here is to make sure you are logged out of ShopPay. One of the easiest ways to do this is to go through checkout in an incognito window.

Why is my HSA/FSA card being declined?

HSA/FSA cards are debit cards, and the most common reason for declines is insufficient funds. Reach out to your HSA/FSA administrator to confirm your balance.

I submitted my Flex itemized receipt for reimbursement and my FSA requires more information.

Please forward us the request from your FSA, and we will work with the Flex team to issue you a new receipt.

Help! I didn’t receive an email from Flex with my itemized receipt and/or letter of medical necessity. What should I do?

Please check your spam folder, as sometimes emails from notifications@withflex.com may be automatically filtered as spam by some email service providers. If you still can’t find it, please email support@withflex.com and let them know the email address associated with your order.

I would like to use multiple HSA/FSA cards to pay for an item. Can I do that?

No, unfortunately, this isn't a supported feature right now. If there are insufficient funds in a single HSA or FSA account, you can instead enter a credit card on the Flex(opens in a new tab) checkout page. You will receive an itemized receipt and/or Letter of Medical Necessity from Flex(opens in a new tab), which you can submit for reimbursement.

My purchase receipt from Ra Optics has a different number than what my FSA was charged. How can we resolve it?

Thanks for reaching out, and apologies for the discrepancy. We'll review the charges and get back to you with details of the likely refund shortly.

Is sales tax covered by HSA/FSA funds, or is it treated separately?

Sales tax for eligible items is also covered by HSA/FSA funds. If the customer has a split cart, the tax will be divided among the cards based on the items.